box 7 1099 r distribution code for conversion Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early . U-Panel is an exposed fastened wall and roof panel. With a ¾” (approximate) rib height and 6” on center rib spacing, U-panel offers a lower profile and softer appearance than R-Panel or Multi-Rib.

0 · irs distribution code 7 meaning

1 · irs 1099 box 7 codes

2 · form 1099 box 7 codes

3 · 1099 r minimum reporting amount

4 · 1099 r distribution codes 7d

5 · 1099 r distribution code meanings

6 · 1099 r code 7 means

7 · 1099 codes explained

Pack your lunch with plenty of snacks into a Ufo lunch box from Zazzle. Choose from plastic or metal lunch boxes to keep your food fresh and safe!

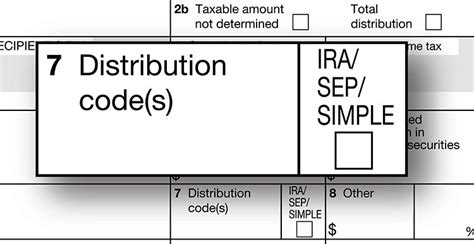

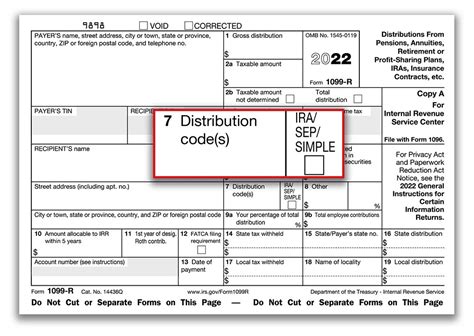

Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, .For a Roth IRA conversion, use Code 2 in box 7 if the participant is under age 59½ or Code 7 if the participant is at least age 59½. Also, check the IRA/SEP/SIMPLE checkbox in box 7.

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your . Which distribution code should your organization use in Box 7 of IRS Form 1099-R when reporting this distribution? Enter code G, Direct rollover and direct payment, when plan participants or IRA owners directly roll over .Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early .

This chart clearly identifies the distribution codes for Box 7 of form1099-R, . All of these corrections must include applicable earnings, these are included in the 1099-R .The following are the instructions for the 1099-R, Box 7 data entry and what each code means. that are not from an IRA, SEP, or SIMPLE are reported on Form 1040, line 1h, Other Earned . One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply . Distribution Code Table entries on Form 1099 on Box 7. amounts reported on Form 1099-R. Description of Codes in Box 7.

Your age dictates the 1099-R conversion code, which appears in box 7 “Distribution code (s).” If you have not yet reached age 59 1/2, your custodian will place a “2” in box 7..Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for .

For a Roth IRA conversion, use Code 2 in box 7 if the participant is under age 59½ or Code 7 if the participant is at least age 59½. Also, check the IRA/SEP/SIMPLE checkbox in box 7.The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. Which distribution code should your organization use in Box 7 of IRS Form 1099-R when reporting this distribution? Enter code G, Direct rollover and direct payment, when plan participants or IRA owners directly roll over non-Roth QRP or IRA assets to an eligible employer-sponsored retirement plan.

Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329; This chart clearly identifies the distribution codes for Box 7 of form1099-R, . All of these corrections must include applicable earnings, these are included in the 1099-R amounts.. Code A: . Use for a direct rollover into another qualified plan or in-plan Roth conversion. 4 (Death) B (Designated Roth) In-plan Roth rollover — use G only.

The following are the instructions for the 1099-R, Box 7 data entry and what each code means. that are not from an IRA, SEP, or SIMPLE are reported on Form 1040, line 1h, Other Earned Income. if filing Form 4972 - Lump-Sum Distribution. box. report amounts in Box 3, Capital gain on Form 8949 as "Form 1099-R Charitable Gift Annuity." box. One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply and explained when to use each. Distribution Code Table entries on Form 1099 on Box 7. amounts reported on Form 1099-R. Description of Codes in Box 7.

irs distribution code 7 meaning

Your age dictates the 1099-R conversion code, which appears in box 7 “Distribution code (s).” If you have not yet reached age 59 1/2, your custodian will place a “2” in box 7..Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for .

distribution-boxes-and-risers

For a Roth IRA conversion, use Code 2 in box 7 if the participant is under age 59½ or Code 7 if the participant is at least age 59½. Also, check the IRA/SEP/SIMPLE checkbox in box 7.The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.

Which distribution code should your organization use in Box 7 of IRS Form 1099-R when reporting this distribution? Enter code G, Direct rollover and direct payment, when plan participants or IRA owners directly roll over non-Roth QRP or IRA assets to an eligible employer-sponsored retirement plan.Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329; This chart clearly identifies the distribution codes for Box 7 of form1099-R, . All of these corrections must include applicable earnings, these are included in the 1099-R amounts.. Code A: . Use for a direct rollover into another qualified plan or in-plan Roth conversion. 4 (Death) B (Designated Roth) In-plan Roth rollover — use G only.The following are the instructions for the 1099-R, Box 7 data entry and what each code means. that are not from an IRA, SEP, or SIMPLE are reported on Form 1040, line 1h, Other Earned Income. if filing Form 4972 - Lump-Sum Distribution. box. report amounts in Box 3, Capital gain on Form 8949 as "Form 1099-R Charitable Gift Annuity." box.

One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply and explained when to use each.

irs 1099 box 7 codes

form 1099 box 7 codes

Choose from our selection of architectural 6063 aluminum U-channels, low-carbon steel U-channels, multipurpose 6061 aluminum U-channels, and more. In stock and ready to ship.

box 7 1099 r distribution code for conversion|1099 codes explained