form 1099-r box 7 distribution codes 1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R . What is a Junction Box: Discover the essential functions of junction boxes in electrical wiring systems. Learn about different types, their key.When your newly constructed or renovated home is ready for electric service, the power company will have to install an electric meter to .

0 · irs distribution code 7 meaning

1 · irs 1099 distribution codes

2 · irs 1099 box 7 codes

3 · distribution code 7 normal

4 · distribution code 7 non disability

5 · 7d distribution code 1099

6 · 1099 box 7 code m

7 · 1099 4 box 7 codes

Before installing a ceiling fan, make sure that you follow the portion of the electrical code that requires that you use a fan-rated outlet box that will support the extra weight and the motion associated with a fan. Learn how to retrofit a ceiling fan electrical box.

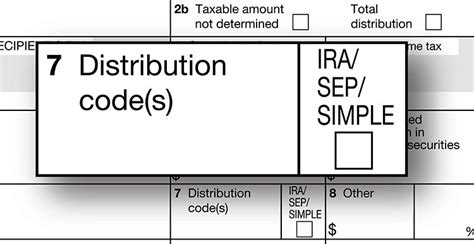

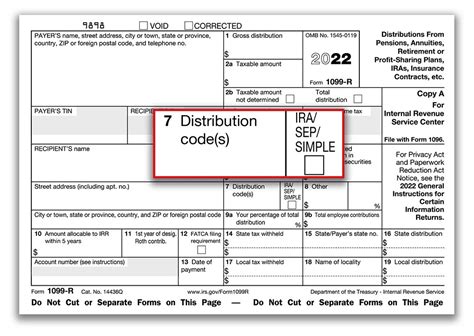

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your . One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code (s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply .

Distribution codes in Box 7 of Form 1099-R tell the IRS what type of distribution you received. These codes indicate if the distribution is subject to early withdrawal penalties, . This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. . Form 1099-R must .

1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R .Form 1099-R, Box 7 codes. The following are the instructions for the 1099-R, Box 7 data entry and what each code means. Codes. 8: Per IRS instructions, distributions with code. 8. that are not . You use code 7 - Normal Distribution in box 7. There is not such code for 7 - Nondisability. That is something that OPM enters on the 1099-R and does not comply with the IRS approved codes for box 7. . Nondisability you enter a code 7 in box 7 of the TurboTax form 1099-R. April 4, 2020 12:02 PM. 0 3,750 Reply. Bookmark Icon. washby . Box 7 is used to report income to you. The different codes within box 7 tell what the tax treatment of any distribution amounts should be. 7 is the code for Normal Distribution (which means it was distributed to taxpayer after age 59.5). D .

B and 2 are two separate codes and must be entered individually in the two drop-down boxes on TurboTax's 1099-R form. Codes B and 2 together mean that the distribution was from a Designated Roth Account in a qualified retirement plan (B) but is not subject to an early-distribution penalty despite you having been under age 59½ at the time of the distribution (2).

1099-R Form Distribution Code Box 7 - G Question Hi, I rolled over 25K amount in 2023 from my 403(b) to Roth 403(b) Plan within the same employer plan. Fidelity sent me a 1099-R form with Distribution Code Box 7 - with Code G ( only one code - no second code). When I entered this information in Turbo Tax 2023, roll over tax is shown as non .

Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R. Do not combine with any other codes. Governmental section 457(b) plans. Report on Form 1099-R, not Form W-2, income tax withholding andForm . 1099-R. 2024. Cat. No. 14436Q. Distributions From Pensions, Annuities, Retirement or . 7 . Distribution code(s) IRA/ SEP/ SIMPLE. 8 . Other $ % 9a . Your percentage of total distribution % . If code C is shown in box 7, the amount shown in box 1 is a receipt of reportableUse Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R. Do not combine with any other codes. Governmental section 457(b) plans. Report on Form 1099-R, not Form W-2, income tax withholding and 1099-R Form Distribution Code Box 7 - G Question Hi, I rolled over 25K amount in 2023 from my 403(b) to Roth 403(b) Plan within the same employer plan. Fidelity sent me a 1099-R form with Distribution Code Box 7 - with Code G ( only one code - no second code). When I entered this information in Turbo Tax 2023, roll over tax is shown as non .

Form 1099-R Box 7 Distribution Codes. Box 7 Distribution . Codes Explanations: 1 — Early distribution, no known exception • If this amount was rolled over within 60 days of the withdrawal and—if the distribution was : from an IRA--no prior rollover was made in the same 12-month period. Check the box 1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498. Instructions on how to enter Form 1099-R on your tax return Form 1099-R Box 7 Distribution Codes (continued) Box 7 Distribution Codes Explanations A — May be eligible for 10-year tax option This code is Out of Scope. B — Designated Roth account distribution Code B is for a distribution from a designated Roth account. This code is in scope only if taxable amount has been determined. D — Annuity . Usually, you should see a code 7 in box 7 on your Form 1099-R. If the distribution is for your RMD for the year, it will be treated as a normal distribution. The code 7 will be marked in Box 7 on your Form 1099-R. Besides, it will also be reported on a Form 5498 "IRA Contribution Information" where box 11 and 12 will be checked .You are not .

One of the most difficult aspects of reporting IRA and qualified retirement plan (QRP) distributions is determining the proper distribution codes to enter in Box 7, Distribution code(s), on IRS Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. Consider the following common IRA and QRP . You would enter the 1099-R with the total distribution in box 1 (the contribution plus the earnings), The earnings in box 2a, Enter code "P" in box 7 (Top) - don t worry that it will say "taxable in 2016 "Enter code "J" in box 7 (Bottom). On the "Which year" screen say that this is a 2018 1099-R. After the 1099-R summary screen press continue. Defining 1099-R Codes. Your age dictates the 1099-R conversion code, which appears in box 7 “Distribution code(s).” If you have not yet reached age 59 1/2, your custodian will place a “2 .

A common compliance mistake occurs when financial organizations use the incorrect distribution code in Box 7, Distribution code(s), on IRS Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit . Content Submitted By Ascensus. One of the most difficult aspects of reporting IRA and qualified retirement plan (QRP) distributions is determining the proper distribution codes to enter in Box 7, Distribution code(s), on IRS .1099-R Codes for Box 7. Haga clic para español. Revised 09/2019. Box 7 Code. . Normal distribution. Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/ .

Codes 1 and M are separate codes in the same box 7 and each code must be selected separately in the two box-7 drop-down boxes of TurboTax's 1099-R form. The code 1 on each of the forms indicates that each of these distributions is subject to a 10% early-distribution penalty unless rolled over to another retirement account or you have a penalty . Solved: Hi! I received a distribution for excess contributions last year (t/y 2020) for a small amount. I also received a 2020 1099-R with the gross . 2020 1099-R Box 7 Code PJ - how to handle . When you enter the Form 1099-R 2020 with code P in your 2019 amended Tax return then TurboTax will include the distribution but ignore the taxes .

irs distribution code 7 meaning

irs 1099 distribution codes

If box number 7 (distribution code) is blank on my 1099-R form what should I do? US En . United States (English) United States . (distribution code) is blank on my 1099-R form what should I do? . Is there an appropriate code somewhere near box 7 that's slightly misplaced? October 10, 2021 6:32 PM.

I received a 1099-R with Box 7 coded as 4D which is correct it is for an Inherited Annuity Total Distribution. In Federal it asks Where is this Distribution From? Select the Source of this Distribution. I select "None of the above" because it is . For a regular retirement distribution, his 1099-R would have a number 7 in Box 7. If there is no code or number there, you should contact the Payor to get a corrected 1099-R. Here's some info about the codes in Box 7: The code(s) in Box 7 of your 1099-R helps identify the type of distribution you received.

irs 1099 box 7 codes

I agree, there should have been no code L1 2019 Form 1099-R since the loan was satisfied by the 2018 offset distribution reported on the code M1 2018 Form 1099-R and you had no loan in 2019 on which you could have defaulted in 2019. You need to obtain a corrected code L1 2019 Form 1099-R from the payer showing Form 1099-R, Box 7 codes. Retirement. Form 1099-R, Box 7 codes. The following are the instructions for the 1099-R, Box 7 data entry and what each code means. . If a 1099-R has more than 1 distribution code in Box 7, you'll need to determine which code should be applied to give the correct tax treatment, then only enter that code. . distributed.

distribution code 7 normal

**If a loan is treated as a deemed distribution, it is reportable on Form 1099-R using the normal taxation rules of a retirement account. The distribution also may be subject to the 10% early distribution tax under Section 72(t).It is not eligible to be rolled over to an eligible retirement plan nor is it eligible for the 10-year tax option. On it, there is a Box 7. (Distribution Code(s)) where it says "2 - NONDISABILITY".TurboTax wants info for a box 7a AND a box 7b. What do I do? . My form has 7-Nondisability in Box 7a on CSA Form 1099-R, but there is no selection for that when filling out the Turbo Tax online form. What selection do I choose as there is nothing that shows Non .

distribution code 7 non disability

Steel box beams can be used in many situations where a lightweight, economical structural beam is required. Standard and custom sizes available.

form 1099-r box 7 distribution codes|1099 box 7 code m