form 1099 r distribution code 1 box 7 If an IRA conversion contribution or a rollover from a qualified plan is made to a Roth IRA that is later revoked or closed, and a distribution is made to the taxpayer, enter the gross distribution . By understanding the function of junction boxes, using the right tools and materials, following a step-by-step guide, and avoiding common mistakes, DIY enthusiasts can tackle wiring projects with confidence.

0 · irs distribution code 7 meaning

1 · irs 1099 distribution codes

2 · irs 1099 box 7 codes

3 · distribution code 7 normal

4 · distribution code 7 non disability

5 · 7d distribution code 1099

6 · 1099 box 7 code m

7 · 1099 4 box 7 codes

Plus, you’ll learn how to wire an outlet in four simple steps. I’ll also mention some common issues that people run into when they’re wiring a standard electrical outlet or switched outlet- in case you’re struggling with something specific.

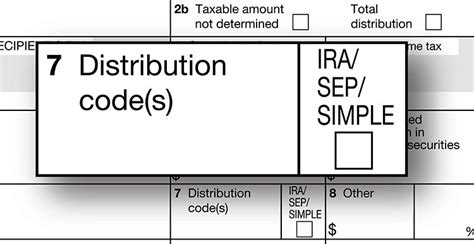

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.If an IRA conversion contribution or a rollover from a qualified plan is made to a Roth IRA that is later revoked or closed, and a distribution is made to the taxpayer, enter the gross distribution .Learn how to report distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, etc. on Form 1099-R. Find out the code for box 7 (type of distribution) and . Distribution codes in Box 7 of Form 1099-R tell the IRS what type of distribution you received. These codes indicate if the distribution is subject to early withdrawal penalties, .

L (Deemed Distribution from Loan) P (Taxable in prior year of the 1099-R year—the year the refunded contribution was made) Code 7: Normal distribution. The distribution is after . One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply .Box 1 reports the total amount of distribution from a retirement plan or annuity, this is the gross amount of dollars you received from the plan. It may be taxable or not depending on many factors. Box 2 reports the taxable amount of the . 1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R .

Information about Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. (Info Copy Only), . File Form 1099-R for each . Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth . 1099-R Form Distribution Code Box 7 - G Question Hi, I rolled over 25K amount in 2023 from my 403(b) to Roth 403(b) Plan within the same employer plan. Fidelity sent me a 1099-R form with Distribution Code Box 7 - with Code G ( only one code - no second code). When I entered this information in Turbo Tax 2023, roll over tax is shown as non .1099-R Codes for Box 7. Haga clic para español. Revised 01/2024. Box 7 Code. . Normal distribution. Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 591/2; (b) for a Roth IRA conversion if the participant is at least age 591/2 .

A Form 1099-R without a code in box 7 is not valid. If you are over age 59½, are you sure that box 7 does not have code 7? It's not uncommon for people to miss seeing a code 7 since it is the same as the box number. . If it was a regular distribution, go ahead and put code 7 in box 7. As dmertz points out, a 1099-R without a code in box 7 is .He received a Form 1099-R with a Gross Distribution in box 1 of ,500 and a distribution code of 1 in box 7. What is the amount of additional tax? Enter the correct amount without using $ signs or period. $ (Please do not use commas in answer) Check My . Usually, you should see a code 7 in box 7 on your Form 1099-R. If the distribution is for your RMD for the year, it will be treated as a normal distribution. The code 7 will be marked in Box 7 on your Form 1099-R. Besides, it will also be reported on a Form 5498 "IRA Contribution Information" where box 11 and 12 will be checked .You are not .

One of the most difficult aspects of reporting IRA and QRP distributions is determining the proper distribution code(s) to enter in Box 7, Distribution code(s) on IRS Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. The following codes and explanations apply to IRA and QRP .

irs distribution code 7 meaning

1099-R Box 7: Distribution Code(s) 1099-R Box 9b: Total Employee Contributions; 1099-R Form Information for Filing; The 1099-R Form . 1099-R form, each with a specific purpose, like a regular W-2 form. This information is found on the right side of the 1099-R form. Box 1- Gross distribution; Box 2a- Taxable amounts, look here to know what you .B and 2 are two separate codes and must be entered individually in the two drop-down boxes on TurboTax's 1099-R form. Codes B and 2 together mean that the distribution was from a Designated Roth Account in a qualified retirement plan (B) but is not subject to an early-distribution penalty despite you having been under age 59½ at the time of the distribution (2).More than 5,000 b. More than 2,000 c. More than 9,000 d. More than 9,000, A lump-sum distribution is reported on Form 1099-R. What is the significance of Box 7 having a code A? a. The distribution is non-taxable. b. The distribution may be eligible for the 10-year tax option method for computing the tax. c.

You use code 7 - Normal Distribution in box 7. There is not such code for 7 - Nondisability. That is something that OPM enters on the 1099-R and does not comply with the IRS approved codes for box 7. . Nondisability you enter a code 7 in box 7 of the TurboTax form 1099-R. April 4, 2020 12:02 PM. 0 3,750 Reply. Bookmark Icon. washby . The distribution codes used in Box 7 of Form 1099-R indicate the type of distribution that was made from the account. The codes range from 1 to 7 and include regular distributions, early distributions, and distributions from inherited accounts.Form . 1099-R. 2024. Cat. No. 14436Q. Distributions From Pensions, Annuities, Retirement or . 7 . Distribution code(s) IRA/ SEP/ SIMPLE. 8 . Other $ % 9a . Your percentage of total distribution % . If code C is shown in box 7, the amount shown in box 1 is a receipt of reportable Distributions from IRAs (IRA/SEP/SIMPLE box marked on the Form 1099-R) are not eligible for this penalty exception. Only distributions from the qualified retirement plan like a 401(k) provided by the employer from which you separated in or after the year you reached age 55 qualify for this exception.

1099-R Codes for Box 7. Haga clic para español. Revised 09/2019. Box 7 Code. . Normal distribution. Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/ . 1099-R Form Distribution Code Box 7 - G Question Hi, I rolled over 25K amount in 2023 from my 403(b) to Roth 403(b) Plan within the same employer plan. Fidelity sent me a 1099-R form with Distribution Code Box 7 - with Code G ( only one code - no second code). When I entered this information in Turbo Tax 2023, roll over tax is shown as non . This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. Services; Investment Advisor Support . (as opposed to Code 8 with the distribution taxable the year of the 1099-R form). 1 (Early Distribution) 2 (Early Distribution—not subject to 10% . On it, there is a Box 7. (Distribution Code(s)) where it says "2 - NONDISABILITY".TurboTax wants info for a box 7a AND a box 7b. What do I do? . My form has 7-Nondisability in Box 7a on CSA Form 1099-R, but there is no selection for that when filling out the Turbo Tax online form. What selection do I choose as there is nothing that shows Non .

Enter the Form 1099-R exactly as received by entering both codes 1 and B. These two codes together indicate that you made a distribution from a Roth account in a qualified retirement plan before age 59½, not a distribution from a Roth IRA. On the Form 1099-R, the payer should have indicated the taxable amount in box 2a and the nontaxable portion in box 5.Form . 1099-R. 2024. Cat. No. 14436Q. Distributions From Pensions, Annuities, Retirement or . 7 . Distribution code(s) IRA/ SEP/ SIMPLE. 8 . Other $ % 9a . Your percentage of total distribution % . If code C is shown in box 7, the amount shown in box 1 is a receipt of reportable What does Distribution Code T mean in box 7 of form 1099-R? It means a Roth IRA distribution, not subject to a early distribution penalty because the IRA owner is over age 59 1/2, disabled or died, but the payer does no know if the 5 year .

irs 1099 distribution codes

Form . 1099-R. 2024. Cat. No. 14436Q. Distributions From Pensions, Annuities, Retirement or . 7 . Distribution code(s) IRA/ SEP/ SIMPLE. 8 . Other $ % 9a . Your percentage of total distribution % . If code C is shown in box 7, the amount shown in box 1 is a receipt of reportable Answered: 2018 form 1099-R Box 7 Distribution Code 81 where to input? Welcome back! Ask questions, get answers, and join our large community of tax professionals. You would enter the 1099-R with the total distribution in box 1 (the contribution plus the earnings), The earnings in box 2a, Enter code "P" in box 7 (Top) - don t worry that it will say "taxable in 2016 "Enter code "J" in box 7 (Bottom). On the "Which year" screen say that this is a 2018 1099-R. After the 1099-R summary screen press continue. A common compliance mistake occurs when financial organizations use the incorrect distribution code in Box 7, Distribution code(s), on IRS Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. IRA owners and qualified retirement plan (QRP) participants who take distributions during a given .

Regarding the code 7 on your Form 1099-R. Does your Form 1099-R have a Code 7? Code 7 indicates a normal distribution. Code 1 indicates an early distribution from a retirement plan (except ROTH), and no exceptions apply (See list below). Code 2 indicates an early distribution (Except ROTH) and an exception applies. If you believe your Form 1099 .

Form . 1099-R. 2024. Cat. No. 14436Q. Distributions From Pensions, Annuities, Retirement or . 7 . Distribution code(s) IRA/ SEP/ SIMPLE. 8 . Other $ % 9a . Your percentage of total distribution % . If code C is shown in box 7, the amount shown in box 1 is a receipt of reportable

If there is no code or number there, you should contact the Payor to get a corrected 1099-R. Here's some info about the codes in Box 7: The code(s) in Box 7 of your 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions, to determine if your distribution is taxable or subject .

irs 1099 box 7 codes

distribution code 7 normal

The light switch wiring diagram depicted here shows the power from the circuit breaker panel going to a wall switch and then continuing to the ceiling light with a three-conductor cable. From the ceiling box, an electrical receptacle outlet is fed power.

form 1099 r distribution code 1 box 7|distribution code 7 normal